India deeptech funding hits $1.55B as AI chips and spacelead growth

TL;DR

On December 22, 2025, ETtech reports that Indian deeptech startups raised about $1.55 billion across 264 deals in 2025, slightly above 2024 levels. Investors say funding will likely stay in the $1–1.5 billion range for the next two years, with semiconductors, spacetech and AI‑led infrastructure drawing the most capital.

About this summary

This article aggregates reporting from 1 news source. The TL;DR is AI-generated from original reporting. Race to AGI's analysis provides editorial context on implications for AGI development.

Race to AGI Analysis

This funding snapshot shows India’s deeptech ecosystem edging forward rather than exploding. $1.55 billion across 264 deals is modest compared with U.S. and Chinese volumes, but the mix matters: semiconductors, spacetech, quantum and AI‑driven infrastructure are now clear favourites. Chip‑design startups alone raised nearly $200 million, a sharp jump over prior years, helped by India’s policy push to build a domestic semiconductor stack.

For the AGI race, these numbers suggest India is slowly building out the “hard tech” complement to its abundant software talent. Frontier AI increasingly relies on custom accelerators, novel packaging and tight integration of sensing, compute and communications. A pipeline of Indian companies working on microcontrollers, secure IoT, industrial AI and space communications won’t move global benchmarks overnight, but it does diversify where key IP is created.

The article also underscores how thin the scale‑up layer still is: fewer than 30 deeptech companies have raised more than $10 million to date. That’s a warning sign that without more late‑stage capital and patient LPs, promising AI‑adjacent hardware and infrastructure plays may stall or be acquired early by foreign buyers. For India to matter in AGI beyond being a massive user base, these early‑stage green shoots need a more robust growth‑stage funding spine.

Who Should Care

Related News

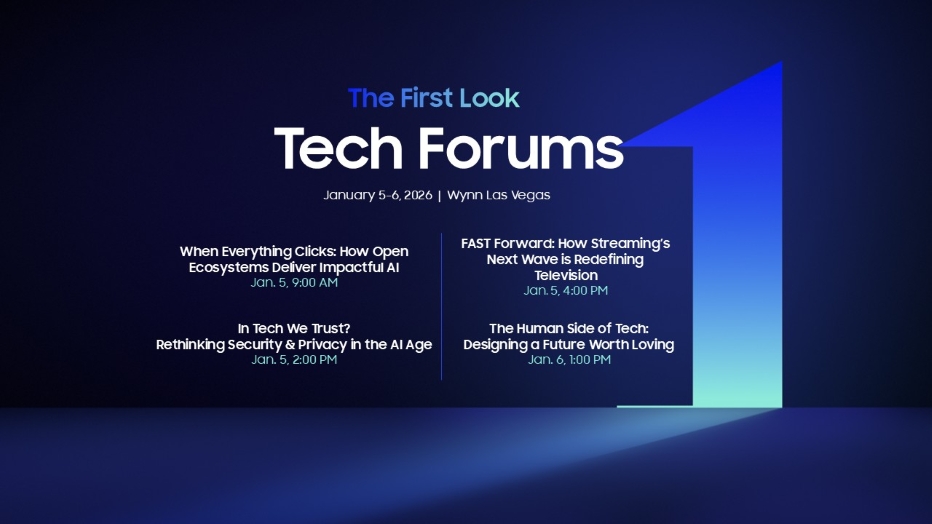

Samsung plans CES 2026 tech forums to showcase AI vision and strategy

Today

Karnataka targets 1 GW AI data hub with $160m+ centre buildout

TodayChina battery giants ride AI data centre boom with 75% storage surge

Today