Sandisk stock jumps 16% as AI storage boom lifts memory names

TL;DR

On January 3, 2026, Sandisk shares surged 15.9% to $275.24 in the first US trading session of the year, as investors piled into flash storage makers seen as key beneficiaries of AI data‑center spending. The move came alongside gains in Micron, Western Digital and Seagate, reinforcing a broader rally in AI‑linked storage and memory stocks.

About this summary

This article aggregates reporting from 1 news source. The TL;DR is AI-generated from original reporting. Race to AGI's analysis provides editorial context on implications for AGI development.

Race to AGI Analysis

The Sandisk pop is one more data point that public markets increasingly see AI as an infrastructure story, not just a model story. As hyperscalers race to build GPU clusters, the limiting factor isn’t just compute; it’s fast, high‑endurance storage that can keep accelerators fed with data. The fact that Sandisk, freshly spun out of Western Digital, is trading like a leveraged bet on AI capex shows how quickly the value chain reprices when investors accept that storage bandwidth is a strategic bottleneck.([ts2.tech](https://ts2.tech/en/sandisk-stock-today-sndk-jumps-16-to-start-2026-as-ai-storage-trade-stays-hot/))

For the AGI race, richer valuations and cheaper capital for NAND and SSD vendors mean the ecosystem can sustain multiple years of aggressive build‑out in training and inference capacity. That doesn’t create new algorithms, but it removes one of the practical brakes on scaling existing architectures. The risk is cyclicality: if AI expectations cool or energy and regulation bite, high‑beta infrastructure names could overshoot on the way down, making future build‑outs harder to finance. For now, though, the market is effectively underwriting the hardware foundation that any plausible AGI contender will run on.

Who Should Care

Related News

AI and chip boom drives record 2025 exports for South Korea

Today

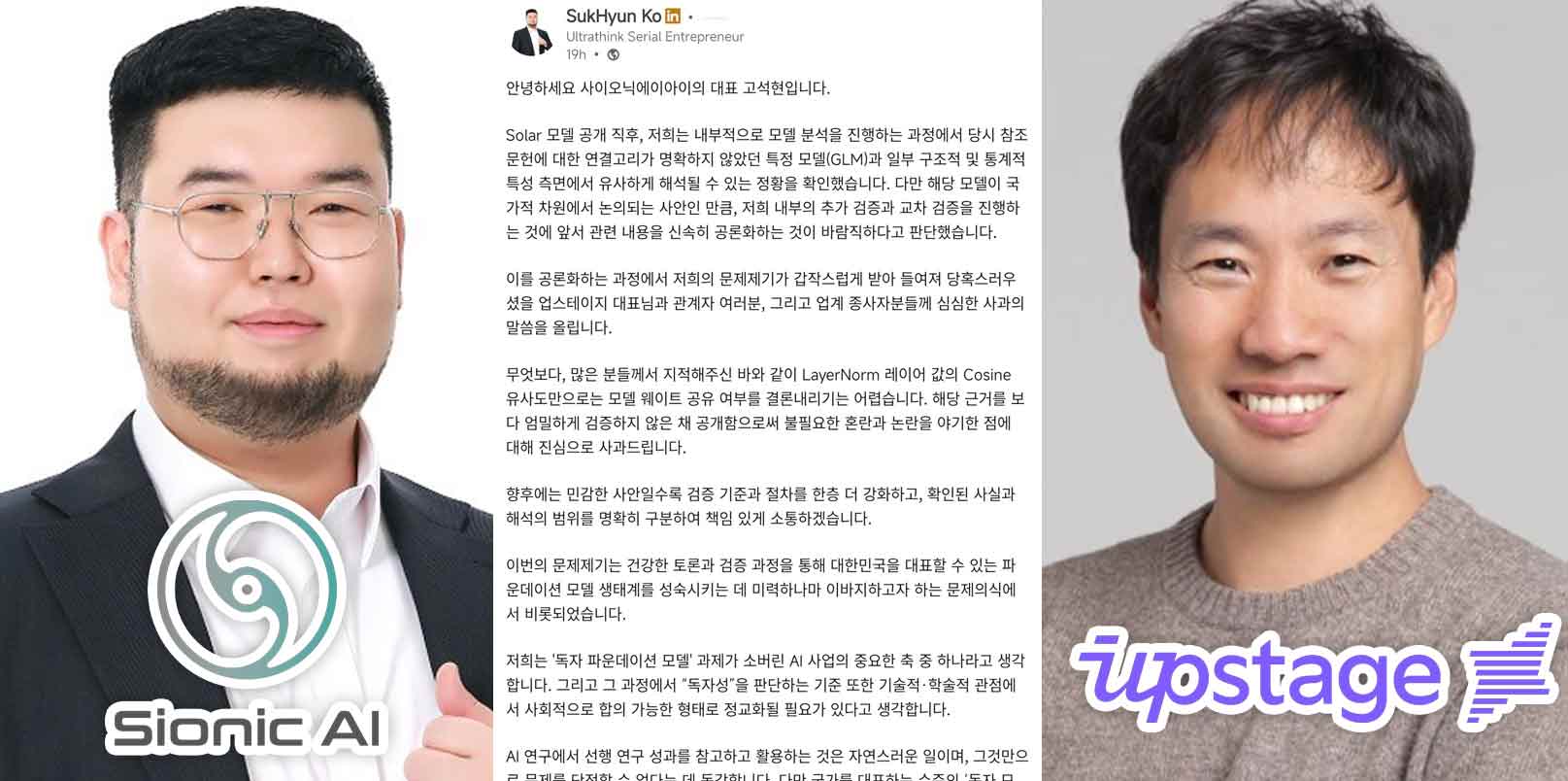

Sionic AI CEO apologises for unproven plagiarism claim against Upstage model

Today

Nvidia–Groq and Meta–Manus deals herald 2026 AI consolidation wave

Today