TCS CEO pegs AI services run‑rate at $1.5 billion with 16% QoQ growth

TL;DR

In comments reported December 18, 2025 at 07:16 IST, TCS CEO K Krithivasan said the company’s annualised revenue from AI services has reached about $1.5 billion, growing 16.3% quarter‑on‑quarter. He told analysts that over 85% of TCS clients with more than $20 million in annual spend now use the firm for AI work, and described an internal push toward an "AI‑first" culture.

About this summary

This article aggregates reporting from 2 news sources. The TL;DR is AI-generated from original reporting. Race to AGI's analysis provides editorial context on implications for AGI development.

Race to AGI Analysis

TCS putting a hard number—$1.5 billion—on its AI services run‑rate is a useful barometer of how quickly enterprise demand is shifting. This is not model training revenue; it’s integration, consulting, and managed services wrapped around models from OpenAI, Google, and an expanding open‑source universe. The 16% QoQ growth suggests that for a Tier‑1 SI, AI is already a material, faster‑growing line of business rather than a peripheral experiment. ([timesofindia.indiatimes.com](https://timesofindia.indiatimes.com/business/india-business/1-5-billion-revenue-from-ai-services-tcs-ceo/amp_articleshow/126048636.cms?utm_source=openai))

In the race to AGI, firms like TCS are key distribution channels. They decide which models and toolchains get normalized inside banks, telcos, and governments across India and beyond. An internal “AI‑first” mantra—asking on every project what AI can do, even at the cost of cannibalising legacy work—means more systematic experimentation with agentic workflows, code generation, and decision support. That will drive real‑world feedback loops into model providers and accelerate the hardening of AI into critical business processes.

It also points to a power shift: frontier labs may own the models, but integrators own the customer relationships and domain context. As AGI‑like capabilities arrive, these intermediaries will have enormous influence over whether they’re deployed cautiously, sloppily, or not at all.

Who Should Care

Related News

Reuters withdraws Nvidia–OpenAI payment story after timing error

TodayAmazon consolidates AI, chip and quantum unit under DeSantis

Today

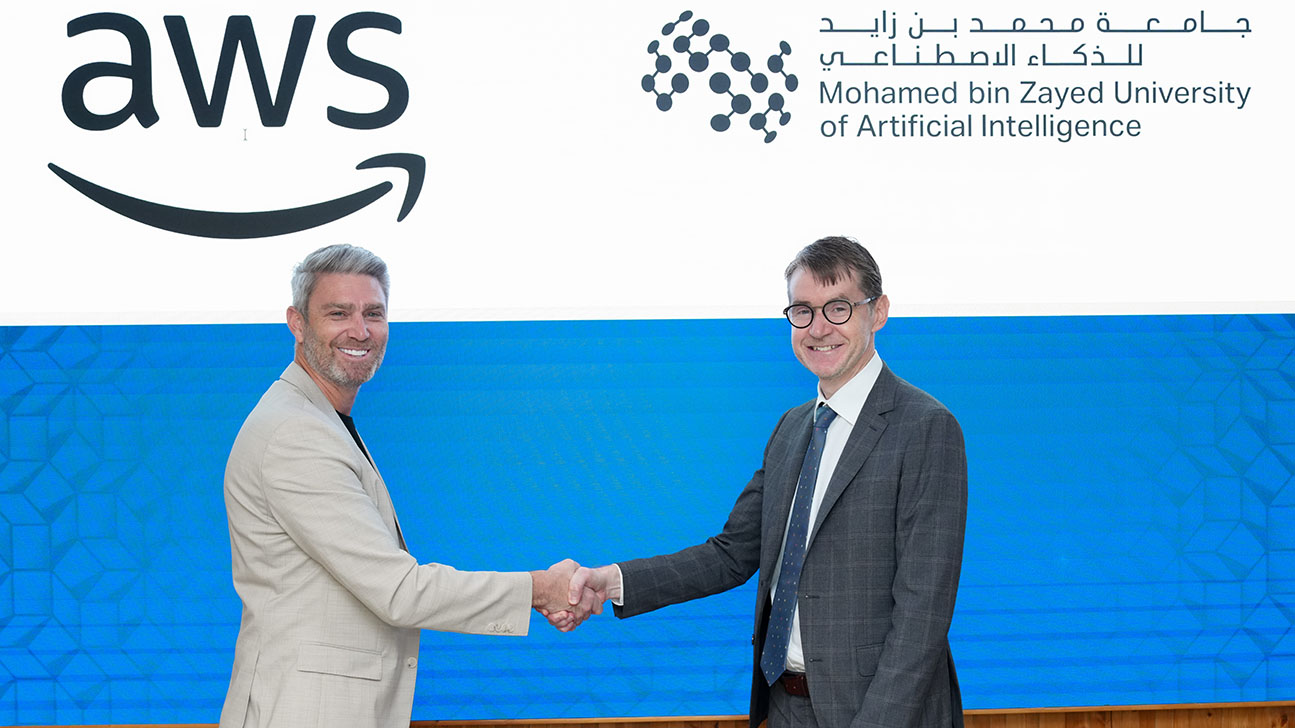

MBZUAI and AWS sign multi-year AI collaboration for research and startups

Today