Databricks raises $4B+ Series L at $134B valuation for AI apps

TL;DR

On December 16–17, 2025, Databricks announced it is raising more than $4 billion in a Series L round valuing the company at $134 billion. Reuters reports the funding is led by Insight Partners, Fidelity and J.P. Morgan Asset Management and will be used for R&D, go‑to‑market expansion and talent retention.

About this summary

This article aggregates reporting from 3 news sources. The TL;DR is AI-generated from original reporting. Race to AGI's analysis provides editorial context on implications for AGI development.

Race to AGI Analysis

This round cements Databricks as one of the most valuable private AI infrastructure companies on the planet, effectively in the same strategic weight class as hyperscalers when it comes to data and model tooling. A $134 billion valuation on a $4.8 billion revenue run rate, with >55% growth and positive free cash flow, signals that investors see its lakehouse and agent platforms as core plumbing for enterprise AI, not just a nice-to-have analytics layer.

For the race to AGI, the key point is where value is accruing: not at the model layer, which Databricks explicitly calls “commoditizing,” but at the stack that connects many models to governed enterprise data and production applications. Their heavy investment in Lakebase, Databricks Apps, and Agent Bricks is a direct bet that AI-native enterprises will run thousands of agents and data‑intelligent apps on top of a unified data plane. That architecture makes it easier to swap in the best frontier or open‑source models without rewriting everything.

This shifts competitive pressure onto foundation model providers to integrate cleanly into these platforms—or risk being abstracted away. It also accelerates deployment of agentic systems in real enterprises, which will generate new feedback loops, datasets, and safety lessons feeding back into the AGI effort.

Who Should Care

Companies Mentioned

Related Deals

Databricks is raising over $4 billion in a Series L round at a $134 billion valuation to fund AI and data platform expansion.

Runware raised a $50 million Series A round led by Dawn Capital to scale its unified API and custom inference infrastructure for multimodal generative AI.

Runware raised a $50 million Series A to expand its real-time generative media API platform and underlying AI inference infrastructure.

Databricks Ventures participates in LangChain's Series B as strategic investor

Fidelity, ICONIQ, and Lightspeed lead Anthropic's $13B Series F at $183B valuation

Related News

Amazon consolidates AI, chip and quantum unit under DeSantis

Today

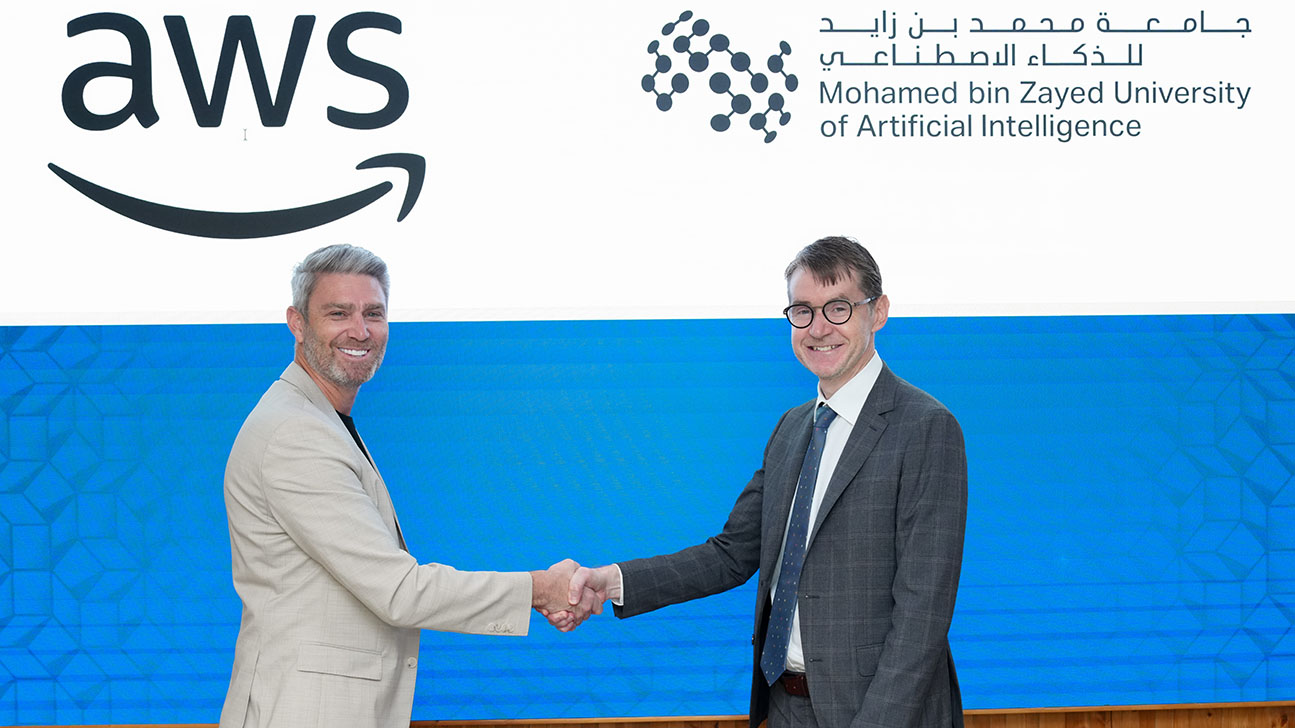

MBZUAI and AWS sign multi-year AI collaboration for research and startups

Today

AMD deepens AI bet with data center and GPU supercycle push

Today