Waymo seeks $15B funding at near $100B valuation to scale robotaxis

TL;DR

On December 16–17, 2025, Bloomberg and other outlets reported that Alphabet’s Waymo is in talks to raise more than $15 billion at a valuation close to $100 billion. The prospective round would be led by Alphabet alongside external investors and would fund fleet expansion and robotaxi deployment in additional US cities.

About this summary

This article aggregates reporting from 5 news sources. The TL;DR is AI-generated from original reporting. Race to AGI's analysis provides editorial context on implications for AGI development.

Race to AGI Analysis

If finalized, this raise would make Waymo one of the best‑funded AI application companies in the world, with a war chest on par with leading foundation‑model labs. While its focus is narrow—autonomous driving—the technical stack it’s scaling is a complex, embodied intelligence system integrating perception, prediction and real‑time decision‑making in unstructured environments. That’s a highly relevant frontier for the broader AGI effort.

Strategically, a $100 billion valuation would validate Alphabet’s long‑term bet that robotaxis can be a standalone platform, not just a research project. It would also embolden investors to treat vertically integrated autonomy players as durable AI winners alongside cloud and model providers. The more miles Waymo logs in dense urban settings, the more data and edge cases it accumulates, feeding a loop that’s hard for competitors to match.

From an AGI‑timeline perspective, the risk is that enormous capital flows into one highly specialized domain could pull talent and compute away from more general research. The upside is that success in large‑scale, safety‑critical autonomy will pressure both regulators and labs to mature verification, simulation and interpretability techniques that can later be ported to more general systems.

Who Should Care

Companies Mentioned

Related Deals

Waymo is reportedly negotiating a funding round exceeding $15 billion at around a $100 billion valuation to expand its robotaxi operations.

Related News

Amazon consolidates AI, chip and quantum unit under DeSantis

Today

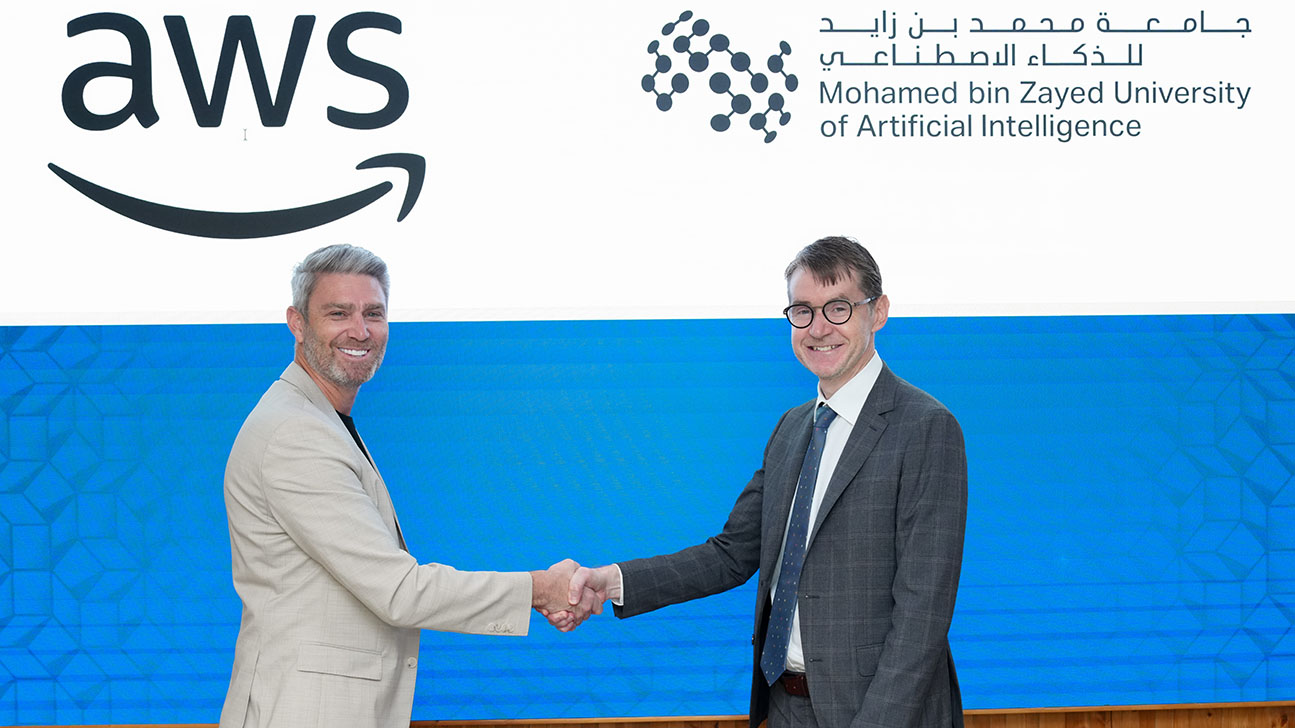

MBZUAI and AWS sign multi-year AI collaboration for research and startups

Today

AMD deepens AI bet with data center and GPU supercycle push

Today